TSMC, a company that rules the world through Chips

The Story of TSMC's Rise

Hi friends👋,

I find myself more active on Twitter than ever since I started writing this newsletter, it’s a vibrant place for quality discussion (if you know who to follow), if you’ve not followed me on Twitter, my handle is @LeiCreatives.

Furthermore, I want to welcome the 15+ of you who joined us in the last 3 days. If you have not signed up yet, join +430 smart, curious, and critical people by subscribing here:

This is a picture of the celebration of TSMC’s 30 year anniversary since its founding. Over 4 trillion dollars worth of company executives were there. TSMC, NVidia, Qualcomm, AD, ARM, Broadcom, ASML, and lastly Apple, this is simply the most distinguished penal I’ve ever seen for a birthday party, and I think it captures the importance of this company lesser known to the public until 2018 when the trade war started. Its name is TSMC, Taiwan Semiconductor Manufacturing Company.

It's incredibly hard for us to fathom today how short it has been since the world's first semiconductor processor was invented. It was Intel 4004 and the year was 1971, exactly half a century ago. Semiconductor and the computer revolution were two sides of the same coin that fueled the first information revolution. Silicon Valley is called Silicon valley precisely because of the semiconductors that were produced there in the early days. It’s not the Internet valley, not a mobile valley, it is the silicon valley.

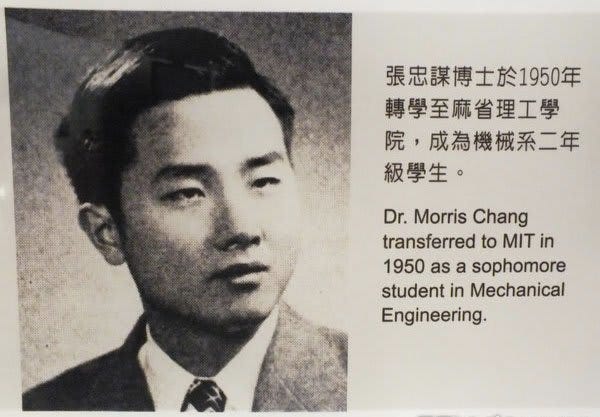

The 1970s were a time of tremendous growth and excitement. Some of the world's biggest technology companies were birthed or grew during that era. Intel, Micron, TI, Microsoft, and Apple. First-generation startups that change our world. TSMC’s founder, Morris Chang’s career kick-started during that phase.

As a Chinese American living through the 60s and 70s, he knew his choices were limited. Graduated from MIT, smart and ambitious, he decided to dive into the semiconductor industry as a researcher.

After 3 years at Sylvania, a small semiconductor company, he moved on to Texas Instruments and rose quickly to become their group vice president overseeing their worldwide semiconductor business in 1983.

He left the company after being told plainly that he is not going to be the CEO. That was 20 years after the semiconductor boom started, he went to Taiwan. He rode on the opportunity of the American industrial upgrade which shifted semiconductor manufacturing to Asia.

In 1987, at the age of 55, Morris took the leap and started TSMC based on an idea that has not been tested before, he wanted to build a “pure-play” foundry.

Back in 1987, most players in the chip manufacturing industry followed what’s called an IDM model, Integrated Device Manufacturer. They integrate the design and manufacturing of chips into one company and do everything alone, these are the Intels of the industry. But what IDMs failed to see is the Fabless innovations that must happen in order for the industry to thrive. What TSMC basically did was to propose a new playbook for all aspiring chip makers that we will build the foundries and manufacture chips, and you can focus on designing and selling the chips instead. We will worry about the heavy lifting and manufacturing excellence, and you can be creative to design the chips that are necessary for next-generation applications. This idea was years ahead of its time, Morris proudly calls it “a solution waiting for a problem”.

And lucky for TSMC, this “problem” happened very quickly, Qualcomm, one of TSMCs biggest customers, was founded two years earlier than TSMC and Yensen Huang started Nvidia in 1993.

Understandably, though Morris was an experienced executive since TSMC’s founding, it was a very tough first 10 years trying to climb up the tech ladder. The company’s revenue rose slowly, this was the labour-intensive model that helped Taiwan and mainland china rise in the last decades, the downside is the meagre revenue as seen above, and the upside is that the workers get proper industrial training. TSMC’s semiconductor was a commodity then.

Seeing the promise of the fabless business model, many competitors entered the market. UMC was founded a few years earlier than TSMC, Vanguard opened its door in 1994 in the same science part where TSMC is located. It’s important to mention that even as recently as ten years ago, TSMC was powerful but not nearly as dominant as it is today. It’s clear from the revenues, TSMC’s revenue rose quickly to 32 billion in 2017 and 45 billion in 2020 (USD), which is 4x TSMC sales in 2009, while its competitors improved anemically.

The most important factor that forever changed the fate of TSMC happened in 2010 over dinner at Morris House in Taiwan. An important guest was visiting, and that was Jeff Williams, then the COO of Apple. And if you don’t know, which I doubt very much, Apple is the biggest company in the world that makes and sells smartphones.

Apple was frustrated with Samsung who makes its chips and also iPhone competitors. From Apple’s perspective, by working with Samsung, they are investing in their top competitor in the industry.

Apple must find someone else for its cheap supply, TSMC is the best choice because what Apple needed in a partner was the capability on the bleeding edge, but can scale with Apple to the hundreds of millions of units in delivery per year. (Apple sells 200 million units per year, TSMC manufactures chips for every one of them)

This was the scale TSMC has never seen and an enormous risk for both sides. TSMC invested 9 billion and had 6000 people working around the clock on their very first project, a gigantic gamble.

Here are the results. TSMC’s revenue quadrupled over the coming years, and its market cap increased 9 fold. A graph is worth a thousand words, literally a 9-fold increase in stock price.

Apple’s orders and investment also pushed TSMC’s technology sophistication to overtake IC leaders like Intel and Samsung. Now, TSMC’s leading-edge chip production volume becomes a solid entry barrier that keeps potential competitors out.

A very different kind of challenge

But in recent years, the struggle of TSMC has become a very different one. It's one that no for-profit company wants to be in. TSMC is now stuck in between the two superpowers, the US and China, in a tug of war. The US wants TSMC to stop working with its Chinese partners like Huawei. It reluctantly did, and China now wanted to set up a separate supply chain bypassing TSMC’s chokehold.

Morris is confident of his ability to navigate the semiconductor landscape, but China is surely a wild beast even TSMC cannot match. To borrow Chinese science-fiction author, Liu Cixin’s concept, the US or China against TSMC is a “dimensionality reduction strike”, they are essentially on a different operating level, the means at the US or China’s disposal is too powerful for any company to withstand.

When TSMC refused to work with Huawei, it became clear to China that it needed a powerful mainland alternative. The Chinese have infinitely deep pockets and that is worrying for TSMC.

It is an incredibly thin rope TSMC is balancing on now.

Looking back, TSMC was pivotal in spearheading the fabless foundry business model and this has helped unleash many fabless companies from the capital-intensive manufacturing process.

But looking ahead, what type of technology is needed to continue TSMCs success still requires much discussion. The semiconductor challenges for smart devices were, how can we make a small chip more and more powerful? And how can we make a small chip more and more energy efficient? TSMC and its partners have answered that through its cutting edge chips with more and more transistors, improving operational speed and energy efficiency.

But in the future, more and more challenges will come from the application side rather than the node sizes. AI, the Internet of Things, autonomous driving will need a different set of propositions from TSMC and alike to keep this industry exciting.

And Morris and his story will live on with his company and this industry he helped build.